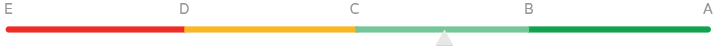

This allows you to compare business credit scores across the globe; having peace of mind throughout every country you trade in. By using the same scoring range and risk descriptions for all countries, we make it easy for you to compare reports.

Although we may not hold information on every company in the world, 99.9% of all business credit reports requested by our customers are delivered instantly online. We don’t store historic reports and will immediately investigate any business we don’t hold information on to deliver fresh commercial insight you can trust.